Our Services

The Southeast LA BusinessSource Center provides start-ups and current small business owners free and cost-effective tools to make your business a success! Working one-on-one with a BusinessSource Center team member will help you navigate your business needs and the tools at your disposal to grow and prosper in the City of Los Angeles. Most services are FREE to South LA business owners and entrepreneurs.

Tax Incentives and Credits

Learn how to identify and manage tax incentives and credit opportunities to get the money you may be entitled to

Workshops & Training

The Southeast BusinessSource Center offers over 40 workshops and entrepreneurial training programs throughout the year to help new entrepreneurs gain the skills and knowledge required to launch and grow their businesses. In addition to our staff, we have subject matter expert contractors ready to deliver a variety of services, including accounting, marketing, certification, and capital access. In addition to our staff, we have subject matter expert contractors ready to deliver a variety of services, including accounting, marketing, certification, and capital access.

Permit Assistance

Southeast LA BusinessSource Center can help you with some common permit assistance needs. Take a look at the links below for additional information

Business Registration

We are here to help you navigate the sometimes-challenging process of registering your business with the City of Los Angeles by assisting with the completion of registration forms and guiding you through the process.

Fictitious Business Name Filings

File, publicize, and verify your fictitious business name

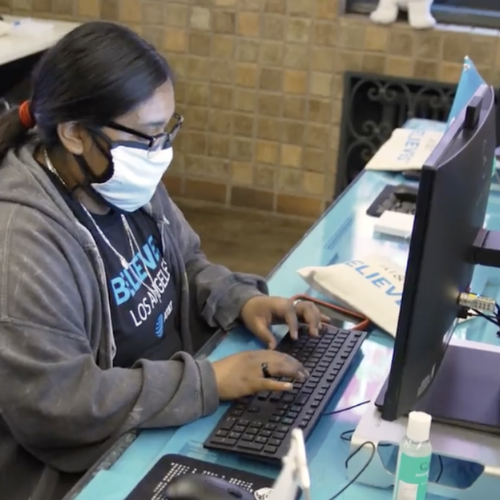

Start-Up Guidance (Self-paced)

Enhance, refresh or learn new solid business skills and principles at your own pace along with the support of our staff as needed

Workforce Development

Looking to hire qualified individuals? CRCD’s the Vernon-Central/LATTC WorkSource Center operated by CRCD provides training and job placement support to small and medium sized businesses seeking staffing assistance. Find out more about our Workforce Development through Coalition for Responsible Community Development (CRCD) (coalitionrcd.org) using the buttons listed below for opportunities.

Adult Workforce Development

CRCD Adult Workforce programs connect dislocated workers, veterans, and justice involved with wrap-around training, employment, and financial coaching services.

Youth Workforce Development

CRCD Youth Workforce offers various programs to provide training and employment opportunities to ensure youth and young adults are prepared to enter the community as educated, skilled, and ready to succeed.

Ask about our sponsored training opportunities and how they can help your business!

Business Certification

Federal

The federal government is the largest purchaser of products and services in the US and the world. There are 24 federal departments primarily responsible for collectively spending at least $500 billion on contracting opportunities. Contact us to research the variety of programs available to help your small business compete for contracts with a federal certification (323)450-7226

State of California

California is home to more than 4 million small businesses, which employ 7.1 million people across the state. Small businesses make up 99.8% of all businesses within the state and employ 48.8% of the state’s workforce, making them a vital part of the Golden State economy. Contact us to review opportunities at the state level and certifications available to your business (323) 450-7226

County

If Los Angeles County were a nation, its economy would be the 19th largest in the world. It is home to more than 244,000 businesses, with more minority- and women-owned businesses than any other in the nation. Los Angeles County's $40 billion budget offers extensive business opportunities to the private sector, both in contracts for goods and services. Contact us to review contracting opportunities available to your business

(323) 450-7226