Financial Assistance

The Southeast Los Angeles BusinessSource Center provides start-ups and current small business owners with options for financing your success. Ready to take your idea to the next level?

SBA 504

-

The SBA 504 Loan Program provides long-term, fixed rate financing of up to $5 million for major fixed assets that promote business growth and job creation. 504 loans are available through Certified Development Companies (CDCs)

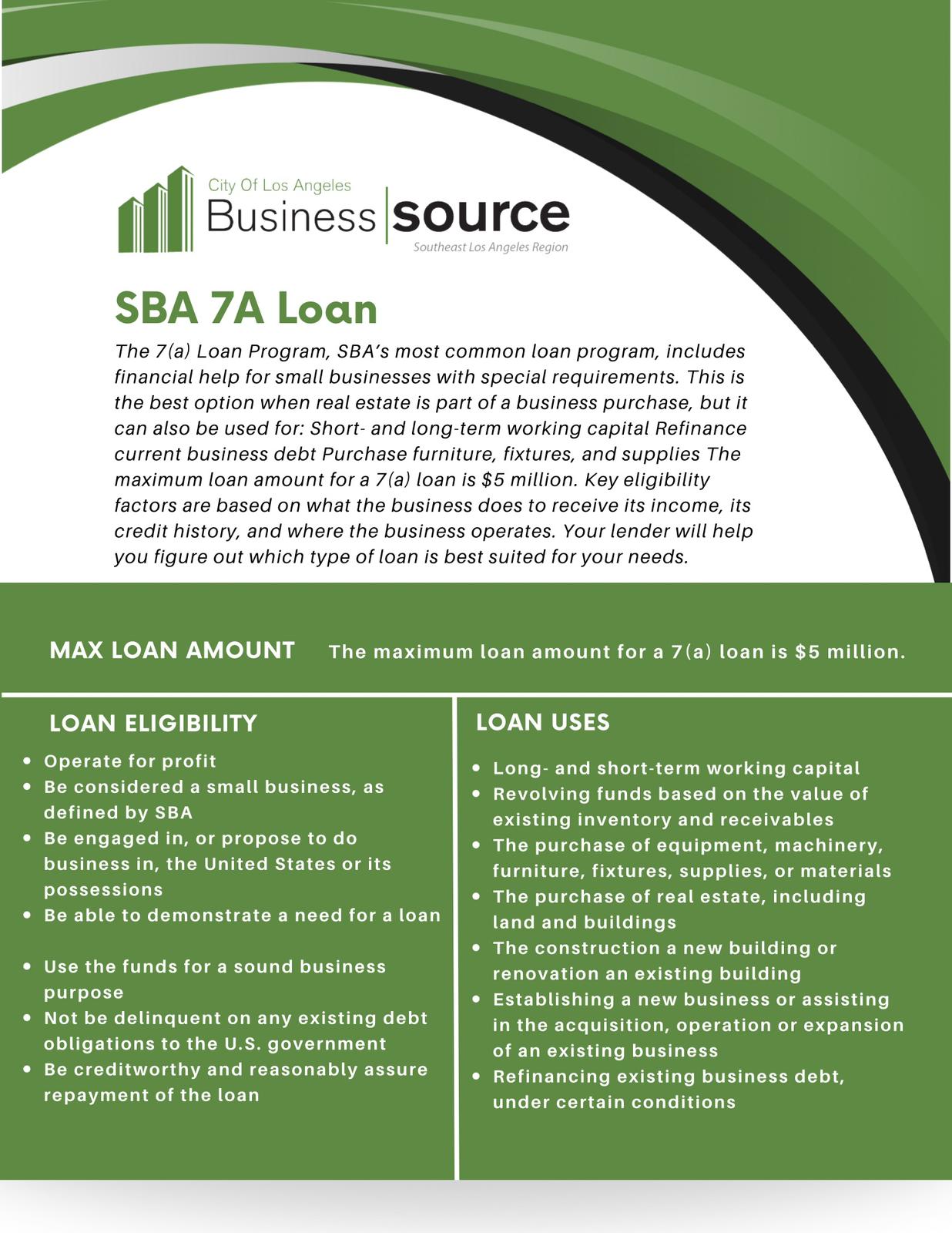

SBA 7A

-

The 7(a) Loan Program, SBA’s most common loan program, includes financial help for small businesses with special requirements. This is the best option when real estate is part of a business purchase, but it can also be used for: Short- and long-term working capital Refinance current business debt Purchase furniture, fixtures, and supplies

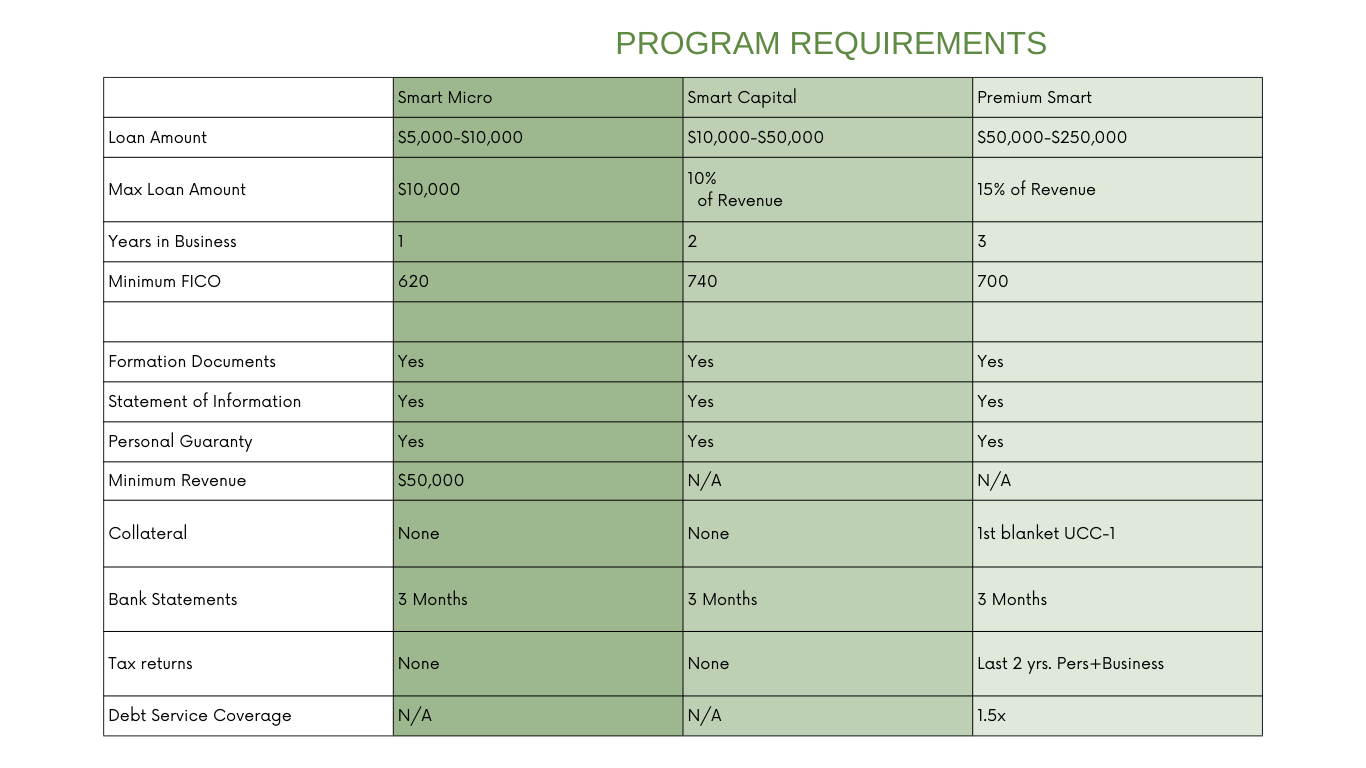

MICROLOANS

-

Southeast BusinessSource Center staff has experience facilitating micro loans up to $50,000 as well as non-conventional small business loans up to $250,000 or more